In 2021, the OECD /G20 Inclusive Framework (OECD inclusive framework) on Base Erosion and Profit Shifting initiative was launched to address gaps in the international tax system and to tackle the tax implications resulting from the digitalisation of the global economy. The Inclusive Framework introduced Pillar 1 and 2 as part of its global reform of the international tax system to determine the allocation of tax liabilities not based on physical presence (nexus rules) and profit distribution following the arm`s length principle (profit allocation rules).

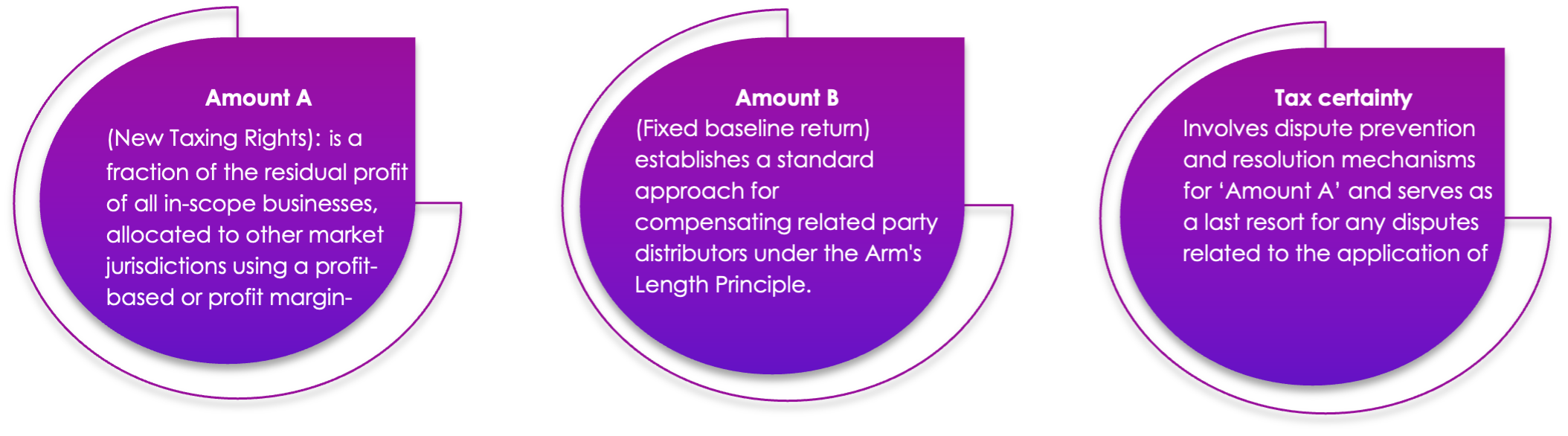

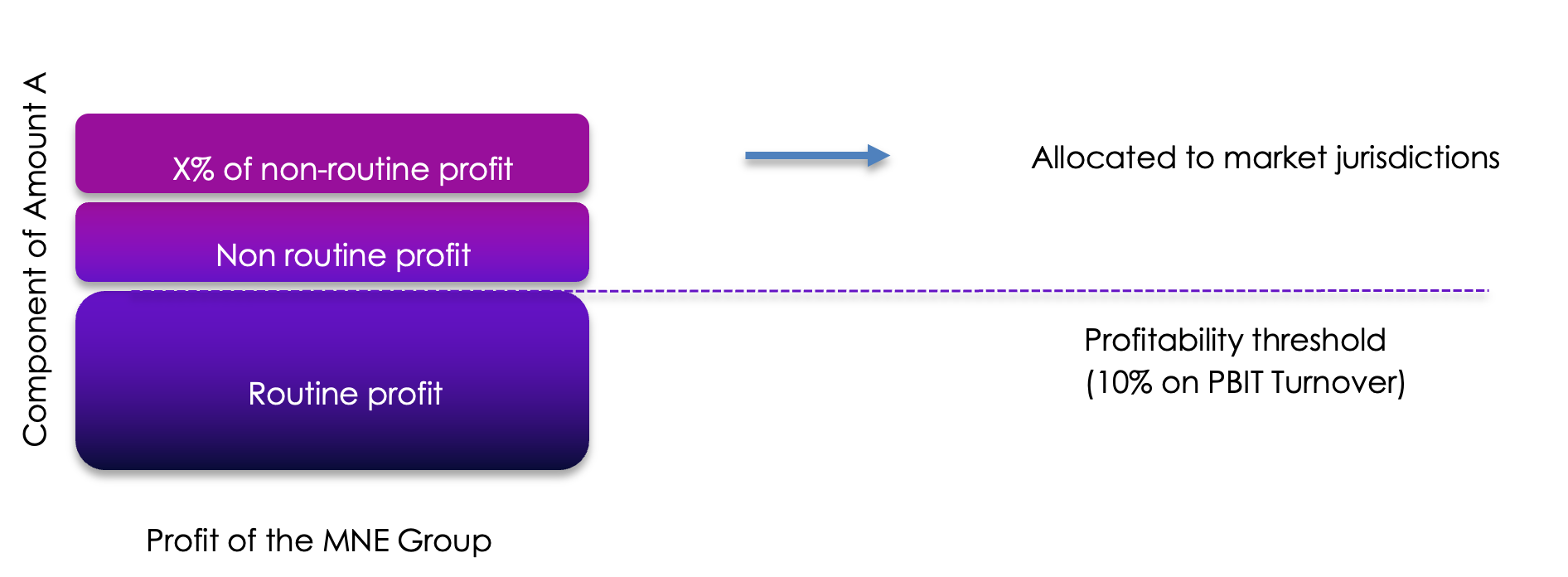

Pillar 1 of the OECD/G20 Framework, known as the (“Unified Approach”) aims to address the complex challenges of taxing the digital economy of various jurisdictions by adapting the international tax system to new business models through changes to profit allocation and nexus rules for business profits. The Unified Approach expands the taxing rights of tax authorities on businesses actively participating in the local economy, whether operating directly or remotely. The key concepts of Pillar 1 involve three types of income allocation to market jurisdictions as outlined below:

Pillar Two establishes a minimum tax rate of 15% on MNEs’ income, irrespective of their operating jurisdictions. It comprises the Global Anti-Base Erosion (GloBE) rules and Subject to Tax Rules (STTR). The GloBE introduces a top-up tax for MNEs operating in jurisdictions with an effective tax rate below 15%, ensuring they fulfil their tax obligations. It applies to Constituent Entities of an MNE Group with over €750 million in revenue every 2 years of a 4-year financial period. GloBE comprises of;

The GloBE introduces a top-up tax for MNEs operating in jurisdictions with an effective tax rate below 15%, ensuring they fulfil their equitable share of tax obligations in the jurisdictions for which they have Constituent Entities.

The major challenges to the successful implementation of the Pillar 1&2 Framework in taxing the global digital economy are:

- The Pillar 1&2 Framework in taxing the digital economy entails the removal of Digital Services Taxes (DST) in domestic tax laws and this could potentially result in lower tax revenues for those jurisdictions especially African economies. The Pillar 1&2 framework requires all participating countries to stop implementing their unilateral digital services tax rules and this will likely affect the successful implementation of the new rules in Africa, as this could be construed as an infringement on a country’s territorial sovereignty. This could partly account for the fact that only twenty-five (25) African countries are members of the Inclusive Framework.

- Furthermore, there are concerns about the allocation of the residual profit realised from the application of the Pillar 1&2. There is the need for more clarification on the criteria for the reallocation of the residual profit especially to less developed and emerging economies.

It is imperative that the above concerns are comprehensively addressed to encourage many developing and emerging economies to join the Inclusive Framework for successful implementation of the Pillar 1&2 framework.

Ghana is not part of the Inclusive Framework and has not taken any measures to implement the provisions of Pillar 1&2 into its domestic laws. Implementation of the OECD’s Pillar 1&2 frameworks in Ghana holds substantial potential for transforming the country’s tax landscape, particularly in addressing the challenges posed by the digital economy and base erosion and profit shifting (BEPS) project.

While it may require significant adjustments and investments in administrative capacity, the Pillar 1&2 Framework has the potential to enhance revenue generation and promote sustainable economic growth.